Regus has operated in the coworking space for decades and has an attractive franchise business model. Long term liabilities and short term assets Twitter commentary on rumors of OYO's recent self dealings This is just one example of poor decision making while chasing growth at all costs. Even more recently, it's been reported that early OYO investors are trying to take money off the table which is generally viewed as a bearish signal for their opinion of where the business is going having seen confidential figures. Just recently Softbank backed OYO had its CEO booked on cheating charges for not making payments to supplier partners. These expectations can only be achieved through questionable business practices. Those massive funding rounds create unreasonable growth expectations that often aren’t supported by the markets these companies operate in when they employ sustainable business models. These massive funding rounds usually start out as a positive since they allow those businesses to scale up quickly and attract talent. Unfortunately these kinds of companies almost never have enough incentive to dig deep and find their competitive advantage because they feel sheltered by venture cash on their balance sheets and are encouraged by the mainstream media telling them that they can do no wrong. Perhaps that’s why WeWork founder Adam Neumann cashed out to the tune of $700M. Entrepreneurs then pray that their startups will identify a long term competitive advantage before the game of musical chairs is up and they walk away from their billion dollar companies with nothing after liquidation preferences and dilution. VCs jam hundreds of millions or even billions of dollars into their startup coffers thinking that money itself is enough of a competitive moat. Many of these companies lack a basic understanding with regards to the history of the hospitality industry. This would actually be ok if they were delivering innovation because they'd be making travel more accessible to consumers in a sustainable way but my sense is that isn't the case and I share why below. They are undercutting prices and killing hotel industry jobs. Most of these so called 'alternative accommodations' players are neither adding unique value nor are they delivering material innovations to the hotel industry like Uber has within transportation. Uber also has the potential to decrease car ownership over the long haul which has a positive environmental impact.

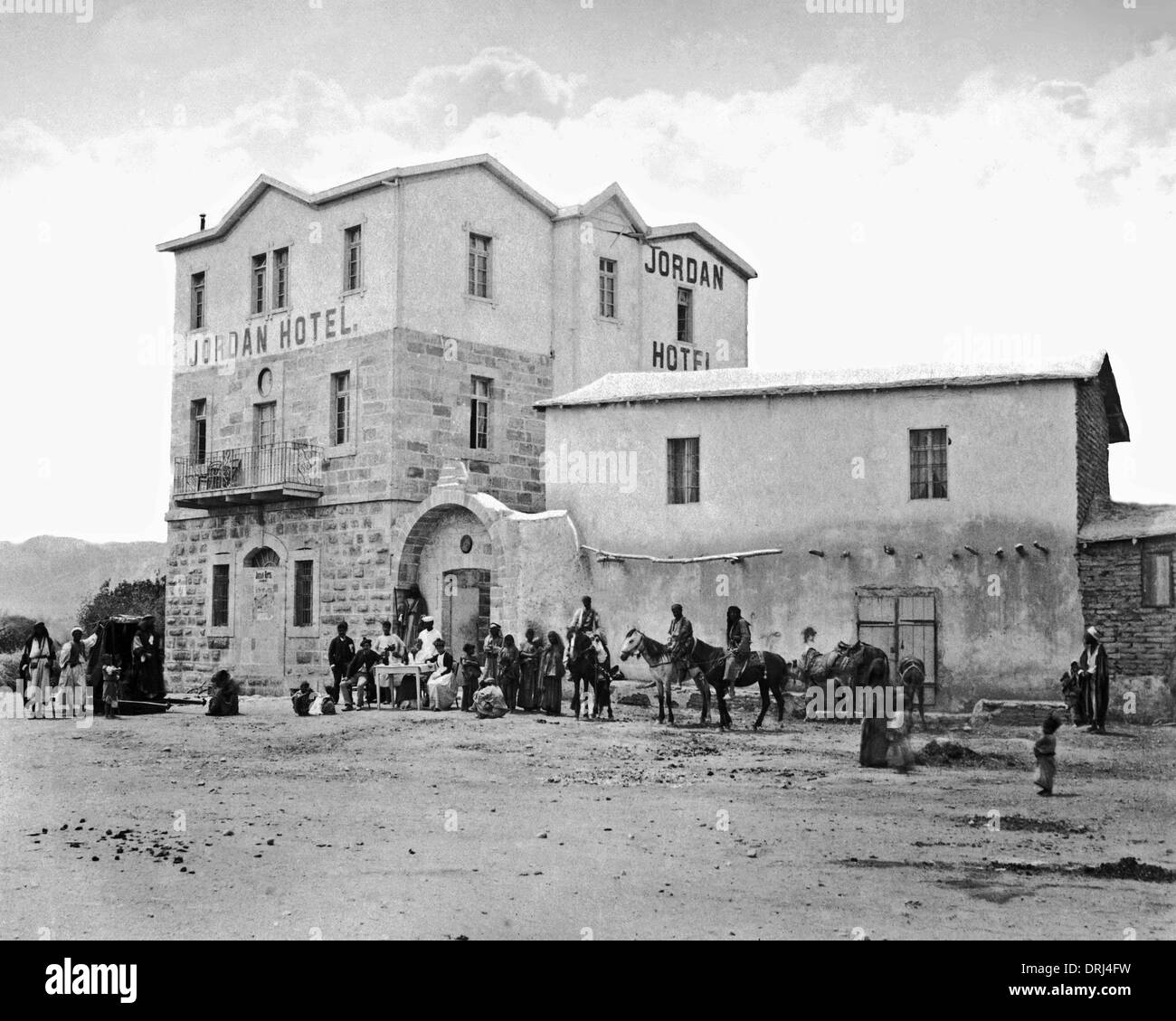

#Jordanian hotel mogul drivers#

The societal impact of Uber on metropolitan areas and drivers is still up for debate but at the very least it has provided an unprecedented level of convenience for consumers which means it's worth the risk of blowing up the traditional market in my opinion. Uber is a controversial company right now but the value it’s created for consumers is undeniable. Most of these businesses are shifting share and not creating real value by growing the market or making it more efficient. The problem is that many of the overfunded businesses today are trying to disrupt hyper competitive markets but few (if any) actually have a true point of differentiation.

#Jordanian hotel mogul series#

Up until recently, VCs could do no wrong in the eyes of the public but after after a series of high profile flops like WeWork and Uber, institutional public equity investors have removed the emerald glasses. Sonder’s recent announcement about it’s foray into the traditional hotel business is just the latest support for this argument.Īn excess of venture capital has encouraged entrepreneurs to seek out tech valuations for real estate companies and it’s going to have devastating effects on the industry that they're allegedly "disrupting". As with most things in life, excess can turn even positivity into toxicity. The problem isn’t venture capital, it’s excess. Venture capital is a critical part of society and progress. In that article I argued that the public perception around the alternative accomodations market is misinformed and that those perceptions have been fueled by venture capitalists drunk on irrational exuberance. Some time ago, I wrote a piece called The WeWork Effect in Hospitality. This article was originally published on 9/28/19

0 kommentar(er)

0 kommentar(er)